This is very off topic. In my defense, the 'General Discussion' tab reads "Talk about, well, just about anything.... Keep it clean and respectful! NO POLITICS".

This is not car related. Anyone here good at managing money?

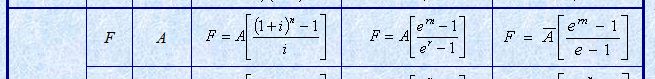

What is the formula for an annuity that that I add to each month, and simultaneously grows at a set interest rate annually?

For example, if I have an annuity that I add $500 to each month, and at the same time grows by 7% every year for 40 years. It is not as simple as compound interest.

Second, what is the formula for a fund that I take a set amount away from every month, yet simultaneously grows by a set interest rate every year?

For example, if I have an account with $100,000 in it that I take $5,000 from each month, yet grows by 2% annually.

Sorry again its so random. I cant find much on the internet. Perhaps we have a member who is an accountant? Thanks!

This is not car related. Anyone here good at managing money?

What is the formula for an annuity that that I add to each month, and simultaneously grows at a set interest rate annually?

For example, if I have an annuity that I add $500 to each month, and at the same time grows by 7% every year for 40 years. It is not as simple as compound interest.

Second, what is the formula for a fund that I take a set amount away from every month, yet simultaneously grows by a set interest rate every year?

For example, if I have an account with $100,000 in it that I take $5,000 from each month, yet grows by 2% annually.

Sorry again its so random. I cant find much on the internet. Perhaps we have a member who is an accountant? Thanks!