Bringing this back up.

I bought a few $10-$30 items off ebay a few weeks ago

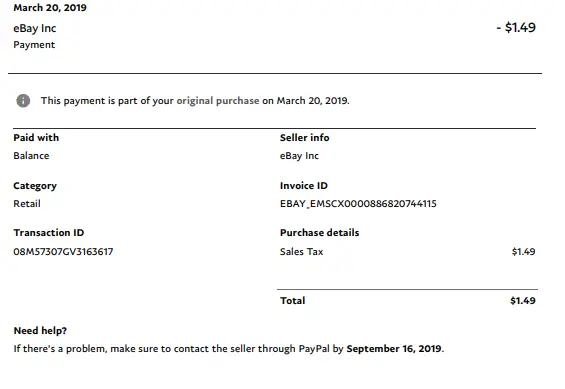

Noticed I had $1-$4 charges in my paypal account recently

Now if you buy something off ebay, say from Bob's Junk G body parts for $20, ebay will see Bob didn't charge you sales tax and proactively charge you your states sales tax.

It continues.....

I bought a few $10-$30 items off ebay a few weeks ago

Noticed I had $1-$4 charges in my paypal account recently

Now if you buy something off ebay, say from Bob's Junk G body parts for $20, ebay will see Bob didn't charge you sales tax and proactively charge you your states sales tax.

It continues.....