Tax law or what?!?

- Thread starter Bonnewagon

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

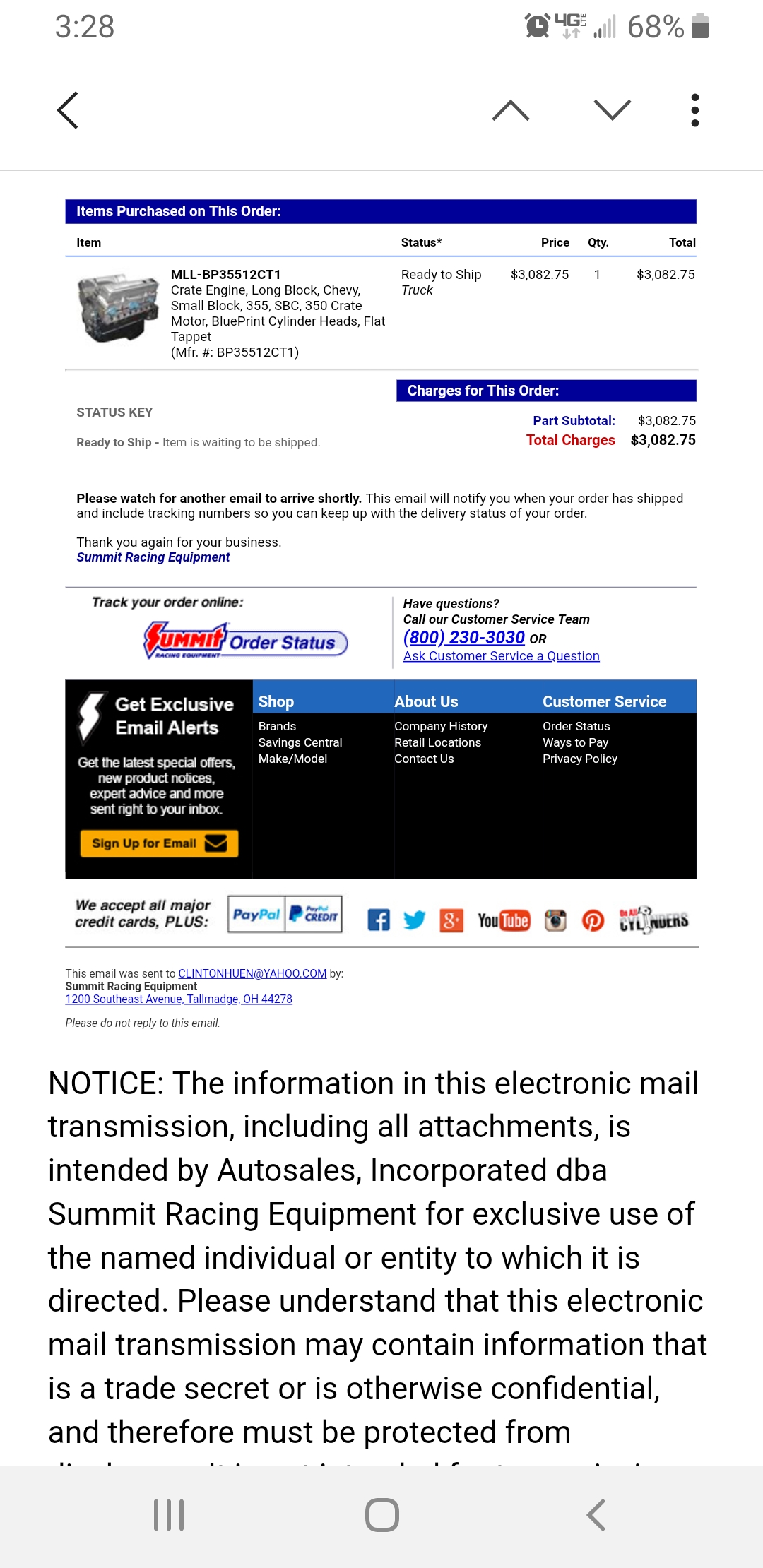

I just bought new sbc for my dad's 77 2wd square body spent $3082.00 and no tax and free shipping. It is shipping out of Texas to Missouri. View attachment 112654

Be aware Missouri has a "use tax" which may apply here. There are certain instances where you do not have to pay the tax, but basically, if the purchase would normally apply for state sales tax, then it would also be equally subject to Use tax, just depends on the situation. Per the Missouri Department of Revenue (see quoted section below from the MDOR website, if the seller does not collect the tax, basically it's on the purchaser to remit the Use tax.

I don't care what you do, just be aware that many states are going to get their money one way or another, if applicable. Don't think they'd chase 5 or 10 bucks for Use tax, but if you owe them hundreds or thousands, not sure how far they'd go. Be careful out there.

-----------------------------------------------------------------

Use Tax

Use tax is imposed on the storage, use or consumption of tangible personal property in this state. The state use tax rate is 4.225%. Cities and counties may impose an additional local use tax. The amount of use tax due on a transaction depends on the combined (local and state) use tax rate in effect at the Missouri location where the tangible personal property is stored, used or consumed. Local use taxes are distributed in the same manner as sales taxes.

Unlike sales tax, which requires a sale at retail in Missouri, use tax is imposed directly upon the person that stores, uses, or consumes tangible personal property in Missouri. Use tax does not apply if the purchase is from a Missouri retailer and subject to Missouri sales tax.

Missouri cannot require out-of-state companies that do not have nexus or a "direct connection" with the state to collect and remit use tax. If an out-of -state seller does not collect use tax from the purchaser, the purchaser is responsible for remitting the use tax to Missouri.

A seller not engaged in business is not required to collect Missouri tax but the purchaser in these instances is responsible for remitting use tax to Missouri. A purchaser is required to file a use tax return if the cumulative purchases subject to use tax exceed two thousand dollars in a calendar year.

Any vendor and its affiliates selling tangible personal property to Missouri customers should collect and pay sales or use tax in order to be eligible to receive Missouri state contracts, regardless of whether that vendor or affiliate has nexus with Missouri.

Section 34.040.6 states, "The commissioner of administration and other agencies to which the state purchasing law applies shall not contract for goods or services with a vendor if the vendor or an affiliate of the vendor makes sales at retail of tangible personal property or for the purpose of storage, use, or consumption in this state but fails to collect and properly pay the tax as provided in Chapter 144, RSMo. For purposes of this section, "affiliate of the vendor" shall mean any person or entity that is controlled by or is under common control with the vendor, whether through stock ownership or otherwise."

For a real headache check out what NY does to you at tax time. And remember that this is tax they "assume" you did not pay and it is based on your income- not any actual sales: Access our website at www.tax.ny.gov2018 Instructions for Form IT-20127Sales and use tax chartYou may use this chart for purchases of items or services costing less than $1,000 each (excluding shipping and handling). You may not use this chart for purchases related to a business, rental real estate, or royalty activities, regardless of the amount.If you maintained a permanent place of abode in New York State for sales and use tax purposes for only part of the year, multiply the tax amount from the chart by the number of months you maintained the permanent place of abode in New York State and divide the result by 12. (Count any period you maintained the abode for more than one-half month as one month.)If yourfederal adjusted gross income(line 19) is: Enter on line 59:up to $15,000* ............................................ $ 12$ 15,001 - $ 30,000 ................................. 23 30,001 - 50,000 ................................. 39 50,001 - 75,000 ................................. 5975,001 - 100,000 ................................. 78 100,001 - 150,000 ................................. 102 150,001 - 200,000 ................................. 119200,001 and greater................................. .060% (.00060)of income, or $250, whicheveramount is smaller* This may be any amount up to $15,000, including 0 or a negative amount.Step 6Line 59 – Sales or use taxReport your sales or use tax liability on this line.You owe sales or compensating use tax if you:• purchased an item or service subject to tax that is delivered to you in New York State without payment of New York State and local tax to the seller; or• purchased an item or service outside New York State that is subject to tax in New York State (and you were a resident of New York State at the time of purchase) with subsequent use in New York State. Note: You may be entitled to a credit for sales tax paid to another state. See the exact calculation method in the instructions for Form ST-140, Individual Purchaser’s Annual Report of Sales and Use Tax.For sales and use tax purposes, a resident includes persons who have a permanent place of abode in the state. Accordingly, you may be a resident for sales tax purposes even though you may not be a resident for income tax purposes. See the instructions for Form ST-140 for more information.You may not use this line to report:• any sales and use tax on business purchases if the business is registered for sales and use tax purposes. You must report this tax on the business’s sales tax return.• any unpaid sales and use tax on motor vehicles, trailers, all-terrain vehicles, vessels, or snowmobiles. This tax is paid directly to the Department of Motor Vehicles (DMV). If you will not be registering or titling it at the DMV, you should remit the tax directly to the Tax Department using Form ST-130, Business Purchaser’s Report of Sales and Use Tax, or Form ST-140.An unpaid sales or use tax liability commonly arises if you made purchases through the Internet, by catalog, from television shopping channels, or on an Indian reservation, or if you purchased items or services subject to tax in another state and brought them back to New York for use here.Example 1:You purchased a computer over the Internet that was delivered to your house in Monroe County, New York, from an out-of-state company and did not pay sales tax to that company. Example 2:You purchased a book on a trip to New Hampshire that you brought back to your residence in Nassau County, New York, for use there.You may also owe an additional local tax if you use property or services in another locality in New York State, other than the locality to which you paid tax. You owe use tax to the second locality if you were a resident of that locality at the time of the purchase, and its rate of tax is higher than the rate of tax originally paid.Failure to pay sales or use tax may result in the imposition of penalty and interest. The Tax Department conducts routine audits based on information received from third parties, including the U.S. Customs Service and other states.If you owe sales or use tax, you may report the amount you owe on your personal income tax return rather than filing Form ST-140.Using the sales and use tax chart below is an easy way to compute your liability for all your purchases of items or services costing less than $1,000 each (excluding shipping and handling) that are not related to a business, rental real estate, or royalty activities.You must use Form ST-140 to calculate your sales and use tax liability to be reported on this return if any of the following apply:• You prefer to calculate the exact amount of sales and use tax due.• You owe sales or use tax on an item or service costing $1,000 or more (excluding shipping and handling).• You owe sales or use tax for purchases related to a business not registered for sales tax purposes, rental real estate, or royalty activities.Include the amount from Form ST-140, line 4, on Form IT-201, line 59. Do not submit Form ST-140 with your return.If the amount reported on line 59 is $1,700 or more, you must complete Form IT-135, Sales and Use Tax Report for Purchases of Items and Services Costing $25,000 or More, and submit it with your return.If you do not owe any sales or use tax, you must enter 0 on line 59. Do not leave line 59 blank. For additional information on when you may owe sales or use tax to New York, see TB-ST-913, Use Tax for Individuals (including Estates and Trusts).For more information on taxable and exempt goods and services, see TB-ST-740, Quick Reference Guide for Taxable and Exempt Property and Services.

Well, yeah, for all 40,000 people in the state. 🙂Delaware. No sales tax!

But there's that "gross receipts" tax which taxes sellers in Delaware.

They get you one way or another pretty much wherever you live. Some screw you harder than others.

Well, yeah, for all 40,000 people in the state. 🙂

But there's that "gross receipts" tax which taxes sellers in Delaware.

They get you one way or another pretty much wherever you live. Some screw you harder than others.

True. But the overall tax rates that the 40,000 of us get screwed with here is better than many others, particularly when compared to our nearest neighbors .

Most online sellers are by now familiar with the term “sales tax nexus” as defined in the Quill v. North Dakota Supreme Court case. Long story short: retailers must have some kind of presence in a state before that state can require that retailer to collect sales tax from buyers in that state.

However, with the Supreme Court ruling in the South Dakota v. Wayfair case, the precedent set by Quill has now been overturned. Now, not only does physical presence (such as a location, employee or inventory), but “economic” presence in a state creates sales tax nexus.

In other words, due to the Wayfair ruling, even if you do not have a physical presence in a state, if you pass a state’s economic threshold for total revenue or number of transactions in that state, you’re legally obligated to collect and remit sales tax to that state.

This post will explain the state of “economic nexus,” discuss what online sellers need to know, and detail each current economic nexus law on the books.

NEW: If you don’t want to go through each economic nexus law line-by-line and compare it to your sales, TaxJar’s Sales and Transactions Checker will instantly check for you and tell you where you have economic nexus. Just connect your online store(s) to the Checker to get started.

What are economic nexus laws?

To combat what they see as an unfair precedent set by Quill, some states prematurely passed laws that read something like, “If an online seller, even though they don’t have a presence in our state, makes more than $X in sales in our state, or conducts more than X number of transactions in our state, then they are required to collect sales tax from buyers in our state.”

These laws were knowingly contrary to Supreme Court precedent. But after the Supreme Court ruling in South Dakota v. Wayfair, states are now free to enforce these laws on businesses.

State laws on economic nexus vary. The sales thresholds vary from $10,000 to $500,000 in sales, and some states don’t have a transaction threshold at all.

How did we get here?

Ohio was the first state to float the idea of economic nexus. Way back in 2005, they passed a “Commercial Activity Tax” (CAT) law. This law stated that any retailer who makes more than $500,000 in sales in Ohio is subject to Ohio’s sales tax collection laws. And that was it – there was no need for that retailer to have an employee, location, inventory, etc. in the state. All they had to do to be subject to the law was make over $500,000 in sales to Ohio buyers.

From there, other states began to follow suit and pass similar laws. It’s probably no surprise that many of these laws were aimed at eCommerce giants like Amazon, which until last year was not collecting sales tax in all U.S. states. Amazon finally buckled and began collecting sales tax from buyers in every U.S. state, but states are still hungry for tax revenue and continue to attempt to enforce these laws on other retailers.

Are economic nexus laws even legal?

We just found out the answer to that is “Yes.” South Dakota passed a particularly aggressive economic nexus law, and the Supreme Court heard the case dealing with this issue this year.

South Dakota Senate Bill 106 stated that any retailer with sales into South Dakota exceeding $100,000 was required to collect and remit South Dakota sales tax. Then they took it a step further by sending out notices of lawsuit to four vendors who they felt met this threshold but were not collecting sales tax: Newegg, Overstock.com, Systemax and Wayfair. Newegg, Overstock.com and Wayfair all fought back through the courts, and the Supreme Court ruled in favor of South Dakota.

Since this ruling has happened, states’ economic nexus laws are now allowed to stand, and some online sellers will be required to collect sales tax in more states than before.

You can read more about South Dakota v. Wayfair here.

What do economic nexus laws mean for online sellers?

Online sellers who did not have the means or the will to fight in court have capitulated and started collecting sales tax from buyers in states with sales tax nexus laws. Other online sellers, banking that these laws wouldn’t stand up in court against the Quill precedent, took a wait-and-see approach and will make a decision regarding sales tax collection after South Dakota v. Wayfair. Now that decision has been made.

Since Quill is overturned, states are free to pursue sales tax from online retailers who exceed the thresholds as stated in their economic nexus laws. However, there’s also a chance that Congress could step in and pass a law regulating sales tax. Right now, we live in a sales tax Wild West, and we’ll be closely following all these decisions as they unfold.

If you meet economic nexus thresholds in some states, we recommend speaking with a vetted sales tax expert to determine your best course of action.

How are economic nexus laws different from notice and report laws?

“Notice and report” laws are state laws that require online sellers with no physical presence in a state to either collect sales tax or provide a significant amount of reporting to states and their buyers if they meet a certain revenue or transaction threshold. While these sound similar to economic nexus laws, they are slightly different.

The biggest difference between economic nexus laws and notice and report laws are that notice and report laws have been legally in effect starting July 1, 2017, starting with the state of Colorado’s notice and report law. Economic nexus laws were not declared Constitutional until June 21, 2018 when SCOTUS handed down their decision in South Dakota v. Wayfair.

As a seller, this could make a big difference to you if have not been sales tax compliant. For example, as of right now, no states have attempted to apply economic nexus sales tax laws to online sellers retroactively. So if you are just now learning about economic nexus, you do have time to become compliant. But if you have not been compliant in states with notice and report laws, you may want to consult a sales tax expert on how to mitigate any damage since these laws have been in effect for several months at this point.

Economic Nexus Laws, by State

Important to note: This area of law is changing rapidly. While we strive to keep this post up to date, please use it as a guideline only and consult with a sales tax expert should you have specific questions as to how economic nexus applies to your business.

However, with the Supreme Court ruling in the South Dakota v. Wayfair case, the precedent set by Quill has now been overturned. Now, not only does physical presence (such as a location, employee or inventory), but “economic” presence in a state creates sales tax nexus.

In other words, due to the Wayfair ruling, even if you do not have a physical presence in a state, if you pass a state’s economic threshold for total revenue or number of transactions in that state, you’re legally obligated to collect and remit sales tax to that state.

This post will explain the state of “economic nexus,” discuss what online sellers need to know, and detail each current economic nexus law on the books.

NEW: If you don’t want to go through each economic nexus law line-by-line and compare it to your sales, TaxJar’s Sales and Transactions Checker will instantly check for you and tell you where you have economic nexus. Just connect your online store(s) to the Checker to get started.

What are economic nexus laws?

To combat what they see as an unfair precedent set by Quill, some states prematurely passed laws that read something like, “If an online seller, even though they don’t have a presence in our state, makes more than $X in sales in our state, or conducts more than X number of transactions in our state, then they are required to collect sales tax from buyers in our state.”

These laws were knowingly contrary to Supreme Court precedent. But after the Supreme Court ruling in South Dakota v. Wayfair, states are now free to enforce these laws on businesses.

State laws on economic nexus vary. The sales thresholds vary from $10,000 to $500,000 in sales, and some states don’t have a transaction threshold at all.

How did we get here?

Ohio was the first state to float the idea of economic nexus. Way back in 2005, they passed a “Commercial Activity Tax” (CAT) law. This law stated that any retailer who makes more than $500,000 in sales in Ohio is subject to Ohio’s sales tax collection laws. And that was it – there was no need for that retailer to have an employee, location, inventory, etc. in the state. All they had to do to be subject to the law was make over $500,000 in sales to Ohio buyers.

From there, other states began to follow suit and pass similar laws. It’s probably no surprise that many of these laws were aimed at eCommerce giants like Amazon, which until last year was not collecting sales tax in all U.S. states. Amazon finally buckled and began collecting sales tax from buyers in every U.S. state, but states are still hungry for tax revenue and continue to attempt to enforce these laws on other retailers.

Are economic nexus laws even legal?

We just found out the answer to that is “Yes.” South Dakota passed a particularly aggressive economic nexus law, and the Supreme Court heard the case dealing with this issue this year.

South Dakota Senate Bill 106 stated that any retailer with sales into South Dakota exceeding $100,000 was required to collect and remit South Dakota sales tax. Then they took it a step further by sending out notices of lawsuit to four vendors who they felt met this threshold but were not collecting sales tax: Newegg, Overstock.com, Systemax and Wayfair. Newegg, Overstock.com and Wayfair all fought back through the courts, and the Supreme Court ruled in favor of South Dakota.

Since this ruling has happened, states’ economic nexus laws are now allowed to stand, and some online sellers will be required to collect sales tax in more states than before.

You can read more about South Dakota v. Wayfair here.

What do economic nexus laws mean for online sellers?

Online sellers who did not have the means or the will to fight in court have capitulated and started collecting sales tax from buyers in states with sales tax nexus laws. Other online sellers, banking that these laws wouldn’t stand up in court against the Quill precedent, took a wait-and-see approach and will make a decision regarding sales tax collection after South Dakota v. Wayfair. Now that decision has been made.

Since Quill is overturned, states are free to pursue sales tax from online retailers who exceed the thresholds as stated in their economic nexus laws. However, there’s also a chance that Congress could step in and pass a law regulating sales tax. Right now, we live in a sales tax Wild West, and we’ll be closely following all these decisions as they unfold.

If you meet economic nexus thresholds in some states, we recommend speaking with a vetted sales tax expert to determine your best course of action.

How are economic nexus laws different from notice and report laws?

“Notice and report” laws are state laws that require online sellers with no physical presence in a state to either collect sales tax or provide a significant amount of reporting to states and their buyers if they meet a certain revenue or transaction threshold. While these sound similar to economic nexus laws, they are slightly different.

The biggest difference between economic nexus laws and notice and report laws are that notice and report laws have been legally in effect starting July 1, 2017, starting with the state of Colorado’s notice and report law. Economic nexus laws were not declared Constitutional until June 21, 2018 when SCOTUS handed down their decision in South Dakota v. Wayfair.

As a seller, this could make a big difference to you if have not been sales tax compliant. For example, as of right now, no states have attempted to apply economic nexus sales tax laws to online sellers retroactively. So if you are just now learning about economic nexus, you do have time to become compliant. But if you have not been compliant in states with notice and report laws, you may want to consult a sales tax expert on how to mitigate any damage since these laws have been in effect for several months at this point.

Economic Nexus Laws, by State

Important to note: This area of law is changing rapidly. While we strive to keep this post up to date, please use it as a guideline only and consult with a sales tax expert should you have specific questions as to how economic nexus applies to your business.

Delaware. No sales tax!

Delaware......... NO NOTHING!!!!!!!!!!!!

- Status

- Not open for further replies.

Similar threads

GBodyForum is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com. Amazon, the Amazon logo, AmazonSupply, and the AmazonSupply logo are trademarks of Amazon.com, Inc. or its affiliates.